In uncertain times, having a solid plan for your finances isn't enough. You also need to anticipate the unexpected. A formal risk assessment process, similar to the way businesses evaluate hazards, can help you proactively assess personal threats to your wealth and security. This risk assessment guide will walk you through a step-by-step process, provide a practical evaluation checklist for financial risks, and show how to weave personal risk planning into your larger financial strategy to help ensure future security.

Just as organizations take a structured approach to risk assessment to identify hazards before those hazards can cause harm, so too can the individual apply the same type of structured approach to threat assessment against their financial well-being. The "hazards" for personal finance may not be slippery floors or faulty machines; rather, they will be life events, economic shifts, emergencies, or some other circumstances that threaten your financial stability.

You then consider, after identifying potential threats, the likelihood of them affecting you and what their impact could be. You then formulate strategies to manage or mitigate those threats. This is at the core of any risk planning process that's fundamental to safeguarding your financial health and future security. Such an approach helps in building a comprehensive map of the vulnerabilities and one for protection.

Before listing the risks, it's useful to define the scope and identify resources. This work you do up front is similar to business operations when conducting organizational risk assessments.

Doing this work upfront helps ensure that you don't omit important areas and that your risk assessment process remains manageable and orderly.

Here are the steps.

Think broadly about what could go wrong. Some common financial hazards, or sources of risk, include the following

The aim is to note down all the risks that one can think of. Ideally, one should be as exhaustive as possible and not exclude even the most improbable eventuality.

For each hazard, think about who may be affected and how. An example may look like this:

This step really forces you to confront, if not the event, at least the ripple it causes among people and responsibilities depending on your financial stability.

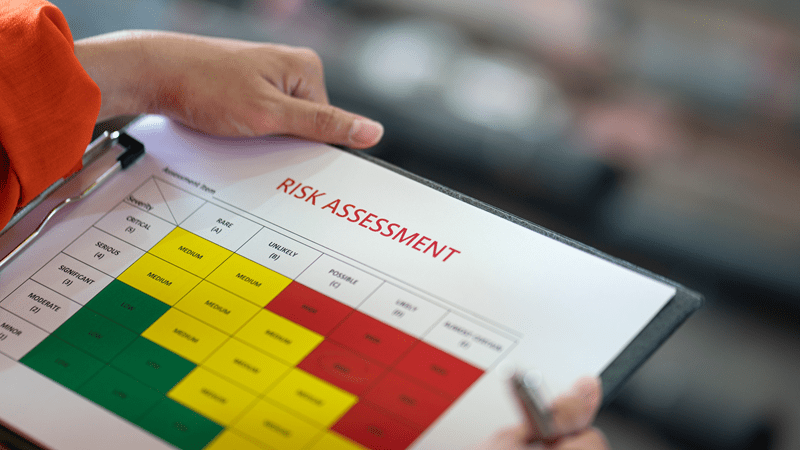

Once you have a listing of the hazards and of the people affected, you need to evaluate each in two dimensions very similar to a risk matrix:

Some outcomes might be improbable but disastrous, such as a serious illness, while others are probable but inconvenient, like a minor job disruption. You can prioritize those that need immediate attention and those that are to be merely monitored by rating each risk for likelihood and impact.

Write it all down: your risks, who's affected, probability, impact, and possible mitigation strategies. It becomes your personal "risk register." Much like in professional processes for risk assessment, writing down decisions and assessments provides clarity and accountability—and helps you revisit the plan over time.

A sample evaluation checklist might look like this:

| Hazard / Risk | Who’s Affected | Likelihood (Low / Medium / High) | Impact (Low / Medium / High) | Mitigation Plan | Priority Level |

| Job Loss | Self + Dependents | Medium | High | Emergency fund (6 months), diversify income, update resume | High |

| Health Emergency | Self + Family | Low?Medium | High | Health insurance, HSA, and disability insurance | High |

| Market Crash (Investments) | Retirement savings | Medium | Medium–High | Diversify portfolio, maintain balanced asset allocation | Medium |

| High-interest Debt burden | Self | High | Medium | Aggressive debt repayment, avoid new debt | High |

| Home/property damage | Family, home value | Low | Medium | Homeowners/renters insurance, emergency maintenance fund | Low–Medium |

This checklist will give a clear picture of the vulnerabilities, safeguards, and priorities for action.

Your life and circumstances change-perhaps new jobs, family additions, market fluctuations, or aging and health changes. It means that your risk analysis must also be living:

A risk assessment is not a standalone document, but works most effectively within an overall financial plan.

You build resilience into your financial plan-not just for what is expected, but also for what isn't-when you integrate risk assessment into all of these components.

A formal process helps you avoid blind spots: many financial crises come from overlooked risks (job instability, health emergencies, unexpected liabilities). It adapts to life changes: because it’s documented and reviewable, your plan evolves as your circumstances evolve. Financial success isn’t just about the money you make — it’s about how well you protect what you have. A personal risk assessment guide, using a structured, step-by-step method inspired by professional risk assessment frameworks, provides you with a roadmap to anticipate threats and prepare for them.

You should revisit your personal risk assessment at least once a year, or sooner if you have a major life event occur, such as a job change, marriage or divorce, birth of a child, relocation, major health change, etc. Regular reviews ensure your plan reflects current realities.

Start where you are. Prioritize the most critical risks (those with high probability and high impact). Even modest progress toward an emergency fund or incremental increases in coverage help. Risk planning is about reducing vulnerability over time — not achieving perfection overnight.

Absolutely. In fact, households with more complex financial structures benefit even more because there are more moving parts. For such households, you may need a more detailed risk register, perhaps including market volatility risk, property risk, and business risk. However, the same five-step process applies: identify hazards, assess who’s affected, evaluate likelihood & impact, record findings, and review periodically.

This content was created by AI