Saving money is not just a financial goal; it's also an important change in how you think about both your life and your finances. When you build up a monthly savings plan, you will gain greater confidence concerning your financial future, reduce some of the stress associated with your financial situation, and create security for you and your family over the long term. Most people struggle to start and be consistent when trying to save money because they do not know how to go about it.

In this article, we will discuss: monthly savings challenges, budgeting tips for beginners, and straightforward ways to track your monthly spending, reduce monthly expenses through recurring bills, and find simple yet effective ways to save money in a manner that does not cause you financial difficulty.

Building a habit of monthly savings provides protection for you and your family during emergencies and allows you to build achievable milestones; you are not surprised by the financial impact of sudden expenses.

Instead of focusing on large annual goals, these challenges break the process down into manageable steps.

When paired with budgeting tips for beginners and proper systems to track monthly expenses, anyone—even someone who has never budgeted before—can succeed.

The challenge of saving money one month at a time is ideal for presenting people with a means to plan financially by adding structure and a game-like experience. Below are examples of how saving $500 can be accomplished through these challenges:

The 30-Day Deposit Challenge requires you to deposit money in a specified amount gross per day (i.e., the amount you deposit on day one is $1, day two is $2, etc). After 30 days, you will have deposited almost $500, and the best part is you won't have to look around at where your money has gone.

Every time you receive a $5 bill, you put it aside. It sounds simple, but it adds up quickly. This challenge is ideal for beginners because it doesn't require major adjustments.

Pick out one week of the month during which you don't spend on anything that isn't necessary. This helps build discipline and helps save more than what was spent on necessities each month.

Use an app or bank that enables automatic rounding up of every purchase. The resulting 'round-up' spending is directly deposited into a savings account.

Instead of starting small, begin with a larger amount at the start of the month and reduce it over time. This creates a psychological win right away.

Flexible and customizable, monthly saving challenges can be tailored to your specific goals, stacked together, and/or rotated based on your overall financial plan.

The main obstacle to saving for most people is a lack of understanding about budgeting. Use basic budgeting techniques to help you create a clear picture of your monthly available income, as well as the resulting monthly expenses and future potential savings.

You will need to develop your own three expense categories.

This step will give you an idea of where you can make adjustments.

This is an easy way for beginners to start budgeting:

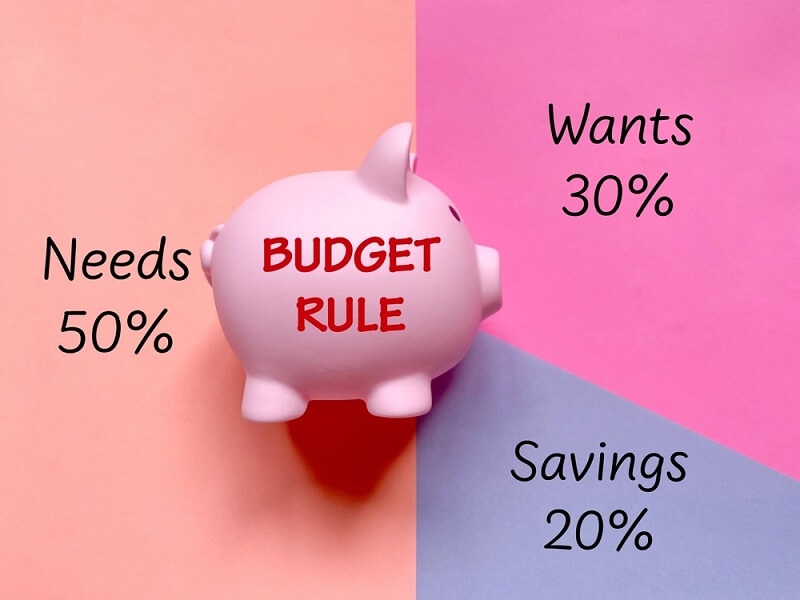

The expectations of every budget should be 50% for the needs category, 30% for the wants category and 20% for the savings category. This is a great way to begin budgeting for new savers.

Budgeting templates provide a comparison between expected and actual spending, enabling you to monitor your expenses throughout each month without feeling overwhelmed.

When going to a place where you have the most money available (i.e., from your paychecks, bonuses, etc.), it is easy to set an auto-transfer to that account every month. Making savings automatic means that it requires little to no effort on your part.

These budgeting methods for beginners will enable you to maintain good discipline and complete the monthly savings challenge by continuing to plan and save every month.

One of the most effective ways of increasing your ability to save money each month is by keeping track of your expenses. If you understand exactly where you spend all your money, you will have control of that money, and it will not have control over you.

Use these tips to track monthly expenses effectively like a pro:

Expense tracking applications, such as Mint, YNAB or PocketGuard, will categorize your transactions automatically and allow you to see trends in your spending habits.

Logging your expenses daily in either digital form or handwritten form increases your awareness of your spending habits and decreases the likelihood of impulse buying.

It is less stressful and easier to review a bank statement weekly than to wait until the end of the entire month.

You may not be able to tell when an expense affects your budget because of payment frequency or recurring expenses, like subscriptions or memberships you don't use. Identify them now to help stop them before they affect your budget going forward.

Once you track monthly expenses, you can find and eliminate waste.

Consistent tracking is crucial because it complements all monthly saving challenges and budgeting strategies.

Recurring bills are one of the biggest obstacles when trying to save money monthly. Cutting them gives you instant and long-term financial relief.

Here’s how to reduce them strategically:

If you’re not using the streaming services and apps or the gym memberships you have, there’s no sense in keeping them. Cancel your subscriptions that aren’t actively being used.

Reach out to your phone, cable, or internet provider and ask about any available discounts. Many companies are willing to provide discounts if you ask them.

Most service providers will give you a considerable discount (typically between 20-40%) for choosing an annual payment option. If you really need the service, choosing an annual payment option will save you money over the long term.

Small acts like turning off lights, adjusting thermostat settings, and unplugging unused devices can cut energy bills each month.

Many financial and utility services offer cheaper alternatives. A quick comparison can save you hundreds yearly.

Cutting recurring bills is one of the quickest ways to save money monthly without sacrificing quality of life.

Sometimes saving needs to happen fast. Luckily, there are plenty of quick ways to save money that don’t require much effort.

Dining out drains your budget fast. Home-cooked meals can save hundreds per month.

Cashback offers, with every purchase, put money back in your pocket.

Most generic products are just about identical in quality.

Wait 24 hours before any non-essential purchase. It prevents impulse buying instantly.

Declutter and get paid for it-too quick way to reinforce savings.

By using quick methods to save money, participating in monthly savings challenges, and making budgeting consistent, a person can establish an excellent foundation for building a solid financial future.

Individually, each of these methods works; however, the ultimate success of these methods will come from combining all methods:

This layered approach ensures you save money monthly with efficiency and confidence.

Saving money is focused on being intentional rather than being restrictive. As long as someone participates in different types of plans that encourage saving each month, creates a plan for how much cash goes out and doesn’t exceed that amount (even if unexpected expenses arise throughout the month), tracks their every expense, and learn to save fast, they will see their savings grow and maintain that growth pattern. With discipline, knowledge, and a commitment to making minor adjustments to their current income, they’ll begin to affect the outcome of their finances as early as today.

You can create a plan to build a habit of saving by automating your savings and monitoring your monthly expenses, and by participating in simple monthly saving challenges.

Monthly saving challenges offer a way to motivate yourself and create a routine for yourself, which makes it easier to save consistently and also gain experience with budgeting techniques that eventually will make budgeting easier and less stressful.

Use budgeting apps, review bank statements weekly, and maintain a daily log. Tracking monthly expenses increases awareness and helps reduce unnecessary spending instantly.

This content was created by AI